31 March 2025

Understanding net zero: why the path matters as much as the destination

The climate challenge for real estate

As we navigate through an era of increasing climate awareness and regulatory scrutiny, it has never been more important for the commercial real estate sector to understand what truly constitutes a net zero approach. The EU Green Deal and Ireland's Climate Action Plan have both highlighted the significant contribution of the built environment to overall emissions and emphasised the critical need to retrofit existing buildings to reduce carbon-intensive materials and transition toward more efficient, electrified buildings.

Despite ambitious targets, Ireland is currently not on track to meet its carbon reduction commitments by 2030, potentially facing substantial financial penalties. Within this context, the Irish Green Building Council has been advocating for whole life carbon assessments that consider both operational and embodied carbon impacts across a building's lifecycle.

At Hibernia Real Estate Group, we recognise that this is not just an environmental imperative – it is a financial one. The growing importance of decarbonisation to protect asset value and prevent stranding of assets has become a central concern for our investors, tenants, and regulators.

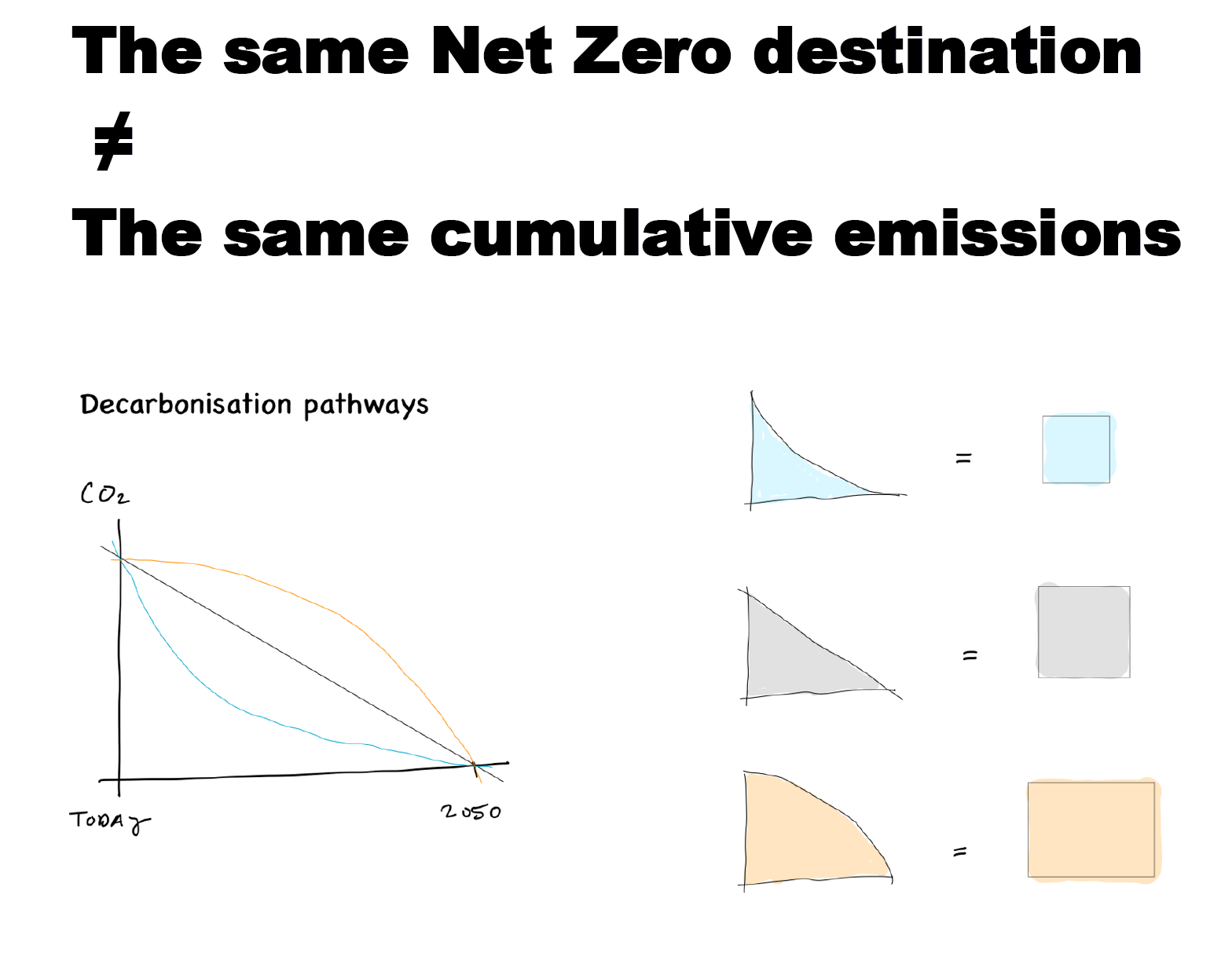

Beyond destination targets: understanding cumulative emissions

The recent research we commissioned from RKD has highlighted a critical insight: when it comes to climate impact, the pathway to net zero matters as much as the destination. Our current strategy, "Transforming Dublin Responsibly," established a solid foundation with clear 2030 targets. However, this new understanding helps us evolve our approach further.

Traditional "destination-based" targets like carbon neutrality or net zero by 2050 do not account for the cumulative emissions released along the journey. The science is clear – it is the total carbon emitted over time that determines climate impact, not just the end state.

This insight reinforces our approach to prioritise early action rather than back-loading decarbonisation efforts closer to 2050. By accelerating our transition now, we significantly reduce our cumulative emissions and align more closely with global climate goals.

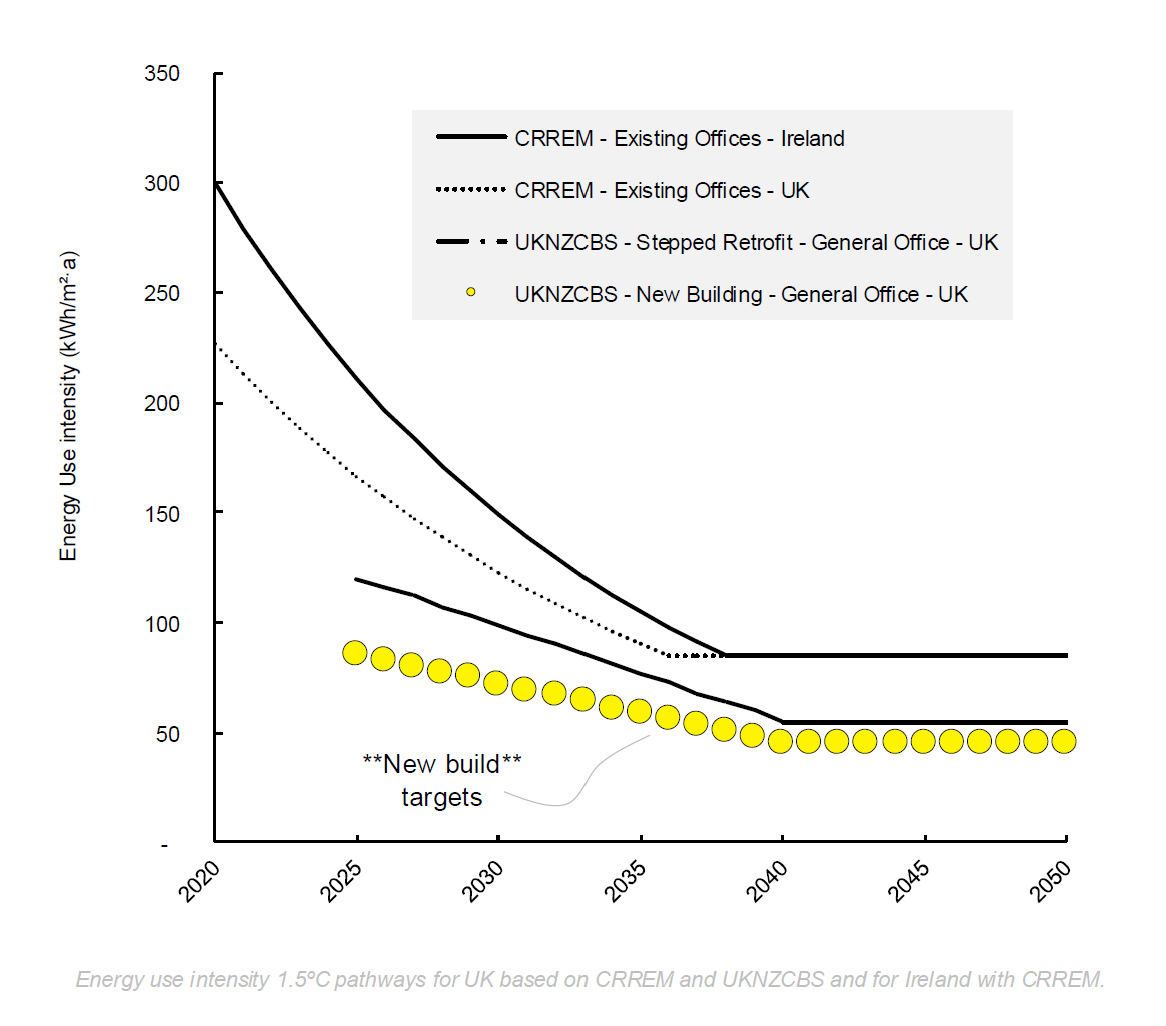

The methodologies behind carbon reduction frameworks like CRREM (Carbon Risk Real Estate Monitor), Science Based Targets initiative (SBTi), and the UK Net Zero Carbon Building Standard provide valuable guidance for our transition. What sets these approaches apart is their focus on yearly targets covering both operational and embodied carbon, rather than single destination targets.

Evolving Hibernia's Net Zero Carbon Pathway

Building on our "Transforming Dublin Responsibly" strategy and existing Net Zero Carbon Pathway, we are enhancing our approach to incorporate these deeper insights into a Climate Transition Plan to be published later in 2025:

1. Yearly targets: We are transitioning from milestone targets to yearly carbon budgets across our portfolio, ensuring we maintain a Paris-aligned trajectory throughout our journey.

2. Whole life carbon: Our decision-making will increasingly integrate both operational and embodied carbon, optimising for total lifecycle emissions rather than focusing on operational performance alone.

3. Early action priority: We recognise that early decarbonisation creates significantly more climate benefit than equivalent actions taken later. Our capital allocation will reflect this urgency.

4. Enhanced disclosure: We will align our reporting with these leading methodologies, providing investors and stakeholders with transparent indicators of our progress against science-aligned pathways.

The case of our Cumberland Place office demonstrates the value of this approach – its energy use intensity is already better than the UKNZCB's 2034 target for retrofitted UK offices and CRREM's 2050 target for Irish offices.

Looking forward

Understanding net zero strengthens Hibernia's ambitions around decarbonisation and climate transition planning. By adopting these sophisticated methodologies, we can make more informed decisions about where to deploy capital for maximum climate impact.

This is not just about compliance or risk mitigation – it is about creating lasting value. The premium for "green" buildings continues to grow, with research showing value increases of 5-45% for sustainable buildings compared to standard ones.

By focusing on both the destination and the journey, Hibernia is positioning its portfolio to thrive in a low-carbon future while contributing meaningfully to Ireland's climate goals. This strengthened approach to decarbonisation represents not just our environmental commitment, but our dedication to creating sustainable value for all our stakeholders.

"Understanding the climate-related ambition of commercial real estate enables better, more effective net zero strategy. The complex nature of carbon budgets and their disaggregation through sectors and regions creates challenges, but also opportunities for leadership. This report aims to help Hibernia bridge the gap between ambition and implementation by providing clarity on what decarbonisation pathways really mean and how they can be effectively applied to both portfolio and asset-level decision making. Companies that truly grasp these concepts will be able to develop climate transition plans that are not only scientifically robust but also commercially viable in a rapidly evolving market." Richard O'Hegarty of RKD.

"At Hibernia, we've always believed that science must underpin our sustainability approach. Visualising decarbonisation pathways for individual assets and across our portfolio isn't just about reporting – it transforms how we collaborate with occupiers to implement informed decisions that drive immediate impact. The ability to see clearly where each building stands relative to science-based trajectories enables both landlords and tenants to prioritise interventions that deliver the greatest carbon reductions. This approach strengthens our 'Transforming Dublin Responsibly' strategy by ensuring we're making the right investments at the right time to protect both environmental and financial value across our portfolio." Neil Menzies of Hibernia REG, Director of Sustainability.

Download full document here.