ESG commitments

Good governance is key to managing business risks and opportunities, whether ESG-related or otherwise. As a result, we have robust structures and processes in place, as outlined in this section.

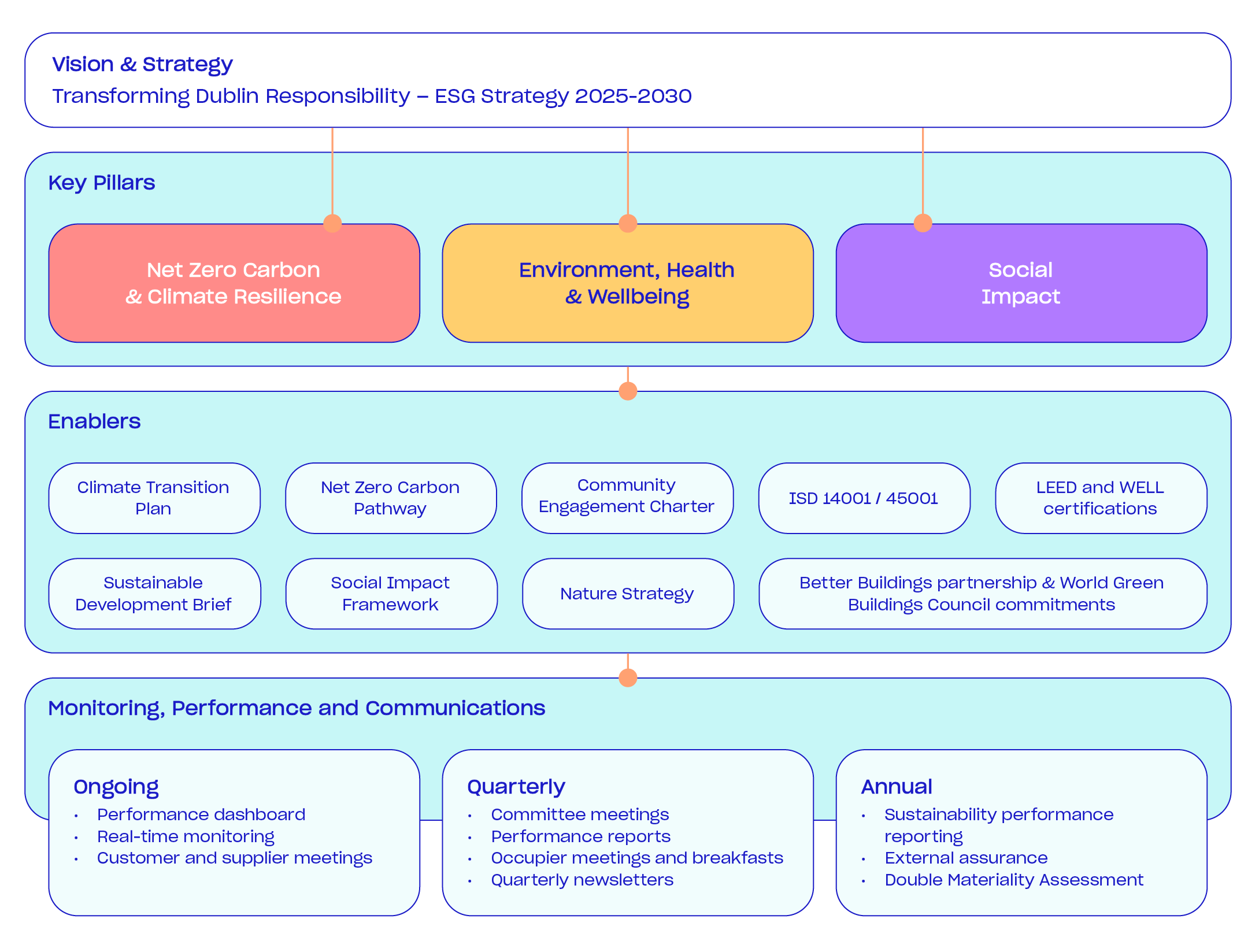

Sustainability Delivery Framework

To implement our ESG Strategy, we use our delivery framework which sets out the structure by which we aim to deliver on our strategy and long-term priorities.

The framework ensures that we have the correct processes in place across our business operations to meet the requirements of this strategy and our policies.

Sustainability governance framework

To ensure the effective implementation of our ESG Strategy there is a clear management hierarchy and accountability pathway within our business.

This starts with the main Board filtering down to the Sustainability Committee and each business function Head, who in turn is required to ensure that our sustainability agenda is integrated into their area of work. To oversee effective day-to-day management, the Director of Sustainability is responsible for overseeing delivery across the business.

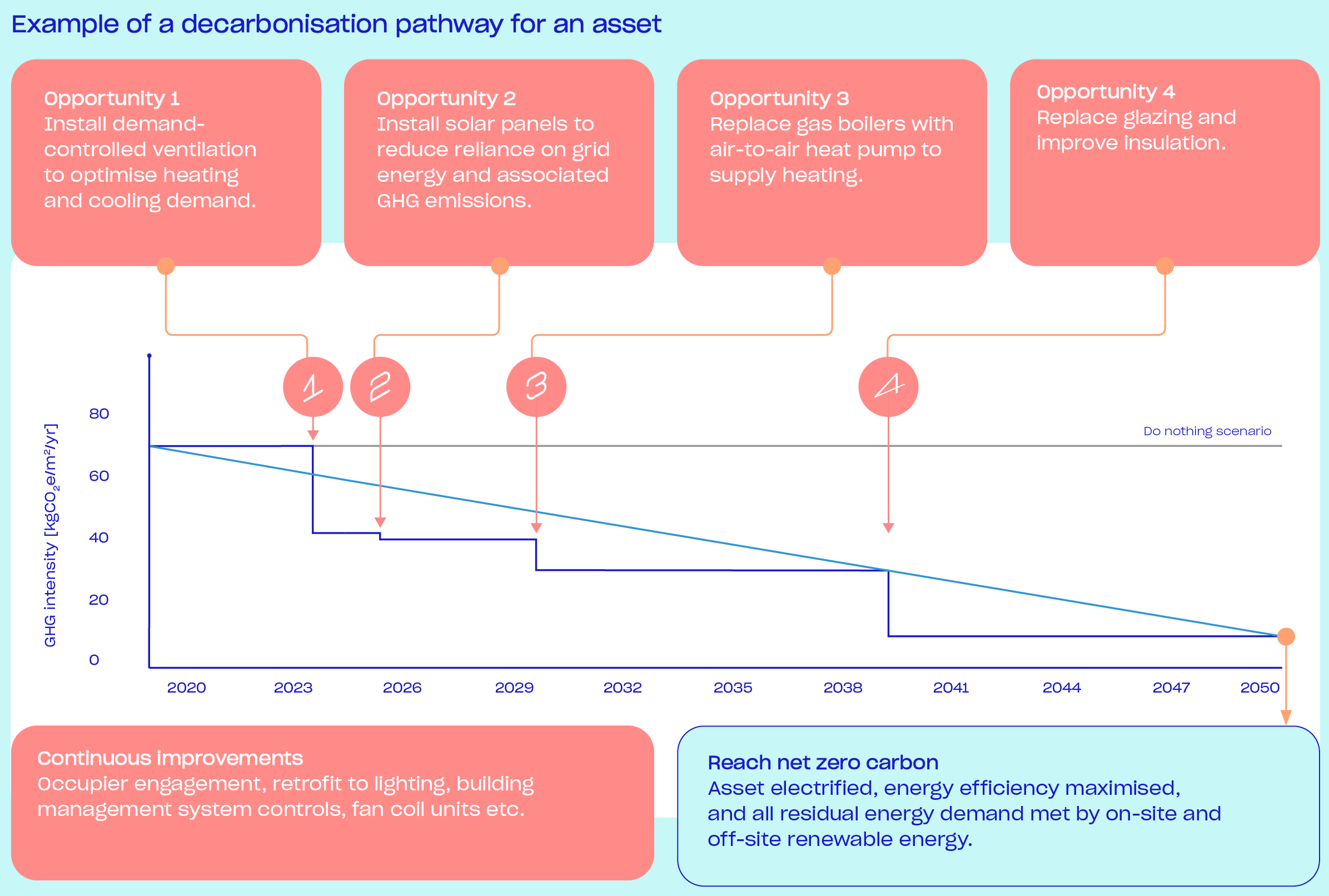

Climate Transition Planning

The Hibernia Climate Transition Plan 2025 addresses several key challenges to ensure a sustainable and resilient future for the company and its stakeholders:

1. Decarbonisation: The plan focuses on eliminating operational carbon emissions through energy efficiency and renewable energy. This includes reducing energy demand, transitioning to renewable energy sources, and minimising embodied carbon in new developments.

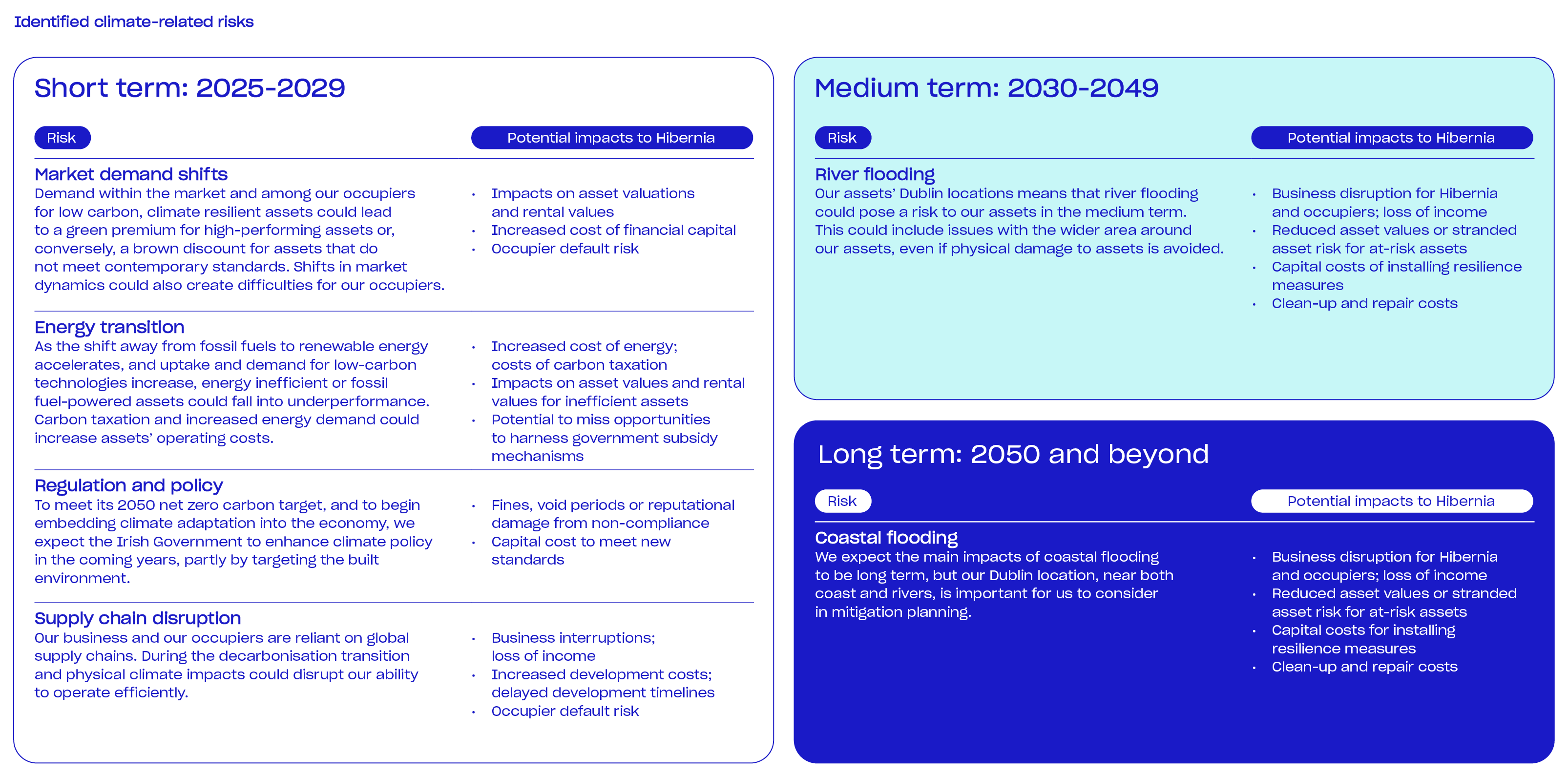

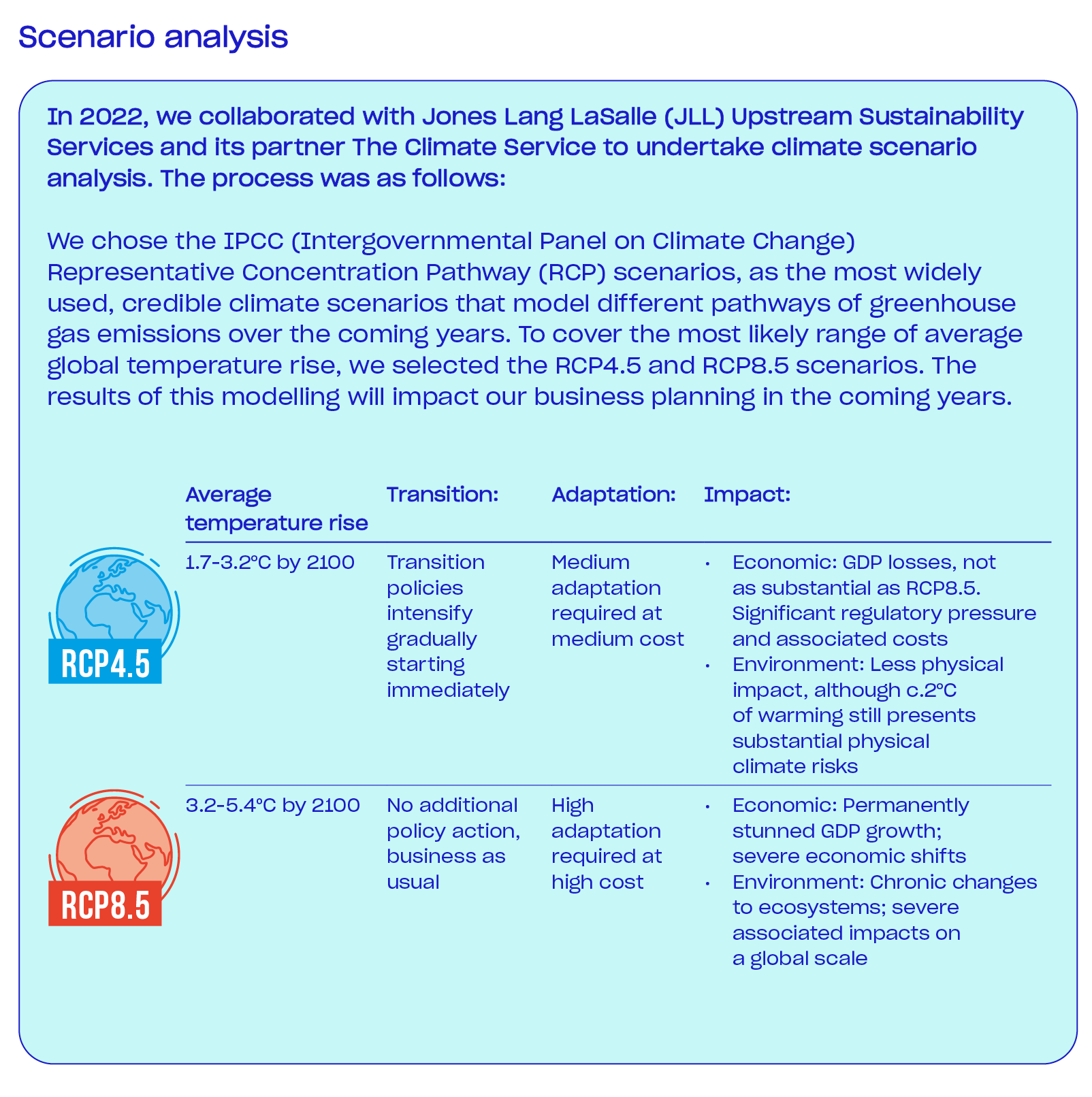

2. Climate Adaptation and Resilience: The plan aims to protect properties against physical climate risks such as surface flooding, intense storms, and extreme heat events. It includes property-specific adaptation measures and portfolio-level strategies to ensure comprehensive climate resilience. While many climate-related risks are likely to materialise over the medium to longer term, the market may begin to price these risks in over the shorter term and, as such, we have taken steps to understand our climate-related risks and opportunities across a breadth of time horizons and against different climate scenarios.

3. Regulatory Compliance: The plan addresses the need to meet tightening climate-related regulations and standards. This includes early action to avoid compliance costs and potential penalties, ensuring properties meet future standards today.

4. Market Dynamics: The plan recognises the shifting market dynamics, where climate-conscious occupiers seek high-performance buildings. It aims to capture market premiums, attract quality occupiers, and access green financing by leading the transition to sustainable buildings.

5. Stakeholder Engagement: The plan emphasises building partnerships with occupiers, suppliers, and communities to amplify collective impact. This includes collaborative initiatives, transparent reporting, and aligning interests around long-term value creation.

6. Financial Strategy: The plan treats climate action as a core business investment, prioritising initiatives based on return potential, risk reduction, and strategic value. It includes innovative financing mechanisms such as green financing instruments and an internal carbon pricing mechanism.

7. Risk Management: The plan includes a comprehensive approach to managing climate-related risks, including physical, transition, and social risks. This involves detailed risk assessments, scenario analysis, and proactive planning to mitigate potential impacts.

8. Continuous Improvement: The plan incorporates continuous improvement and adaptation to evolving climate conditions, stakeholder expectations, and regulatory requirements. This ensures the company remains at the forefront of climate action and maintains its competitive advantage.

These challenges are addressed through a combination of strategic planning, stakeholder collaboration, and innovative solutions to ensure Hibernia's successful transition to a sustainable economy.